SaaS companies operate in a fast-paced market where valuation metrics like saas multiples play a key role in determining their worth. These multiples, applied to metrics like annual recurring revenue (ARR) or EBITDA, help establish a clear saas company valuation.

For business owners, understanding these factors is essential for planning an exit strategy, negotiating with investors, and driving growth.

Equally important is presenting your saas business model effectively online. Using proper SEO structure with H1, H2, and H3 tags ensures your content is both easy to read and optimized for search engines. This combination of strong saas metrics and effective digital communication can boost visibility in the saas market while attracting potential investors.

At VH-info, we’ve seen how aligning valuation insights with strategic content structure gives saas businesses a competitive edge in funding rounds and acquisitions.

This article dives into the importance of saas multiples and SEO strategies to help you grow your business in the evolving technology industry.

What Are SaaS Multiples?

SaaS multiples represent the ratio between a company’s enterprise value and its financial metrics. These valuation multiples function as multiplication factors applied to metrics like annual recurring revenue (ARR) or EBITDA to determine a saas business valuation.

For example, if the current market establishes that saas companies typically sell for 5x their ARR, a company with $2 million in ARR might be valued at approximately $10 million.

Various types of multiples apply to saas valuation:

- Revenue Multiples remain the most common for saas businesses, especially for growing companies that haven’t reached profitability. The saas capital index, which tracks these multipliers across public saas companies, shows that revenue multiples typically range from 3x to 15x depending on growth rate, market conditions, and business model specifics.

- EBITDA Multiples apply more commonly to mature saas businesses with established profitability. These typically range from 8x to 20x for private saas companies, with higher multiples reserved for larger companies with exceptional metrics.

- SDE (Seller’s Discretionary Earnings) Multiples often apply to smaller companies and typically range from 2x to 4x for saas businesses, reflecting the higher risk of smaller operations.

The saas market demonstrates significant variability in these multipliers based on company stage, with early-stage startups sometimes commanding higher revenue multiples despite lower absolute revenue, thanks to their growth trajectory.

Meanwhile, established saas companies might see valuation tied more closely to profitability metrics and cash flow stability.

Why Are SaaS Multiples Important?

SaaS Multiples form the foundation of how technology companies value each other.

For saas business owners, these metrics directly impact:

- Exit Planning: Whether targeting acquisition by larger companies or planning an IPO, multiples set expectations for potential returns.

- Funding Negotiations: Investors use comparative multiples to benchmark your valuation against similar saas companies.

- Strategic Decisions: Understanding how specific metrics impact valuation helps prioritize growth initiatives versus profitability goals.

- Competitive Analysis: Tracking multiples across the saas industry provides insights into market trends and investor preferences.

For small businesses in the SaaS area, multiples are very important. They can decide if founders have big exits or just small gains after many years of work. For public SaaS companies, changes in multiples can affect stock prices.

This happens even if the main business does not change. The SaaS business model has steady revenue streams. Usually, it gets higher multiples than old business models. However, this higher value comes with hopes for ongoing growth and smart customer costs.

This requires a deep understanding of SaaS Buyer Personas to ensure marketing efforts are effective and fall within a planned SaaS Marketing Budget.

Factors Influencing SaaS Multiples

Multiple key variables impact saas multiples, with growth rate standing as perhaps the most influential factor. Companies demonstrating 80%+ year-over-year growth often command revenue multiples 2-3x higher than those growing at 20-30%, even with similar revenue bases.

Revenue quality significantly affects valuation multiples:

- Annual recurring revenue provides stability and predictability

- Net revenue retention above 120% signals a product that expands within its customer base

- Gross margins above 80% indicate software-driven rather than service-dependent models

Customer metrics like customer acquisition cost (CAC) and customer lifetime value (CLV) directly influence saas multiples. A well-defined SaaS Content Strategy and targeted campaigns like PPC For SaaS are important for optimizing these metrics.

Companies with CLV:CAC ratios above 3:1 demonstrate efficient growth mechanics, warranting higher multiples.

Macroeconomic factors also impact saas valuation multiples:

- High interest rates compress multiples across the board as investor return thresholds increase

- Market volatility typically reduces buyer appetite for higher-risk companies

- Sector trends and emerging SaaS Trends can boost or depress multiples independent of company performance. Using the right SaaS Analytics Tools allows companies to monitor their performance against these trends and make data-driven decisions.

Cash flow traits become more important as companies grow. The cash burn rate compared to growth rate shows how sustainable a business is. Positive cash flow can really help raise values for firms with over $10M in annual recurring revenue.

Profitability measures matter more as companies get older. Early-stage startups may get high values just from their growth. But later-stage firms are checked on their spending and how they plan to make a profit.

A company’s edge from tech barriers, network effects, or strong market position can lift values above average levels. This is especially true for firms that use artificial intelligence well in their main services.

How To Calculate SaaS Multiples?

Calculating SaaS multiples requires identifying the appropriate financial metrics and applying the correct multiplication factor.

The process varies based on company stage and available data.

For Revenue-Based Multiples:

Enterprise Value (EV) ÷ Annual Recurring Revenue (ARR) = ARR Multiple

For EBITDA-Based Calculations:

Enterprise Value (EV) ÷ EBITDA = EBITDA Multiple

For Smaller Companies Using SDE:

Sale Price ÷ Seller’s Discretionary Earnings = SDE Multiple

When benchmarking against public saas companies, trailing twelve months (TTM) revenue often serves as the denominator. For high-growth private saas companies, investors sometimes use a forward-looking metric based on current ARR * (1 + growth rate).

The median valuation multiple varies by company size:

- Companies under $1M ARR: 3-5x ARR

- $1-10M ARR companies: 5-8x ARR

- $10-50M ARR businesses: 6-10x ARR

- $50M+ ARR enterprises: 8-15x ARR

These ranges change every three months. There are big changes in Q1 2024 compared to Q4 2023. These changes are due to different interest rates and market factors. The average EBITDA profit margin also differs by company size.

Larger companies usually show better efficiency than smaller ones. A key metric that investors track is the Rule of 40 SaaS, which combines growth and profitability to gauge a company’s health.

Some firms, like FE International and Aventis Advisors, share regular data on SaaS value multiples. They cover various company sizes. This data gives useful reference points for business owners who are thinking about an exit plan.

How To Use H1, H2, and H3 Tags For SEO?

Proper heading structure is key for good SEO in SaaS companies. This setup helps with search visibility. It also makes the user experience better. User engagement is very important to search engines today.

The H1 tag shows your page’s main topic. It should have your target keyword near the start. For SaaS companies, this usually means using terms like “SaaS multiples” or “SaaS business value” in the main title.

Each page needs one H1 tag that matches or is close to the page title. This tells search engines what your content is about and helps users understand it right away.

H2 tags break your content into big sections. H3 tags divide these big sections into smaller parts. This builds a clear content structure that search engines can read easily. It also helps users find relevant information fast.

SaaS businesses gain a lot from having a good heading structure when explaining tough topics.

Whether you are creating a detailed SaaS Infographic or sharing insights through SaaS Newsletter Examples, clear headers let clients and investors find info about your SaaS numbers or business model quickly.

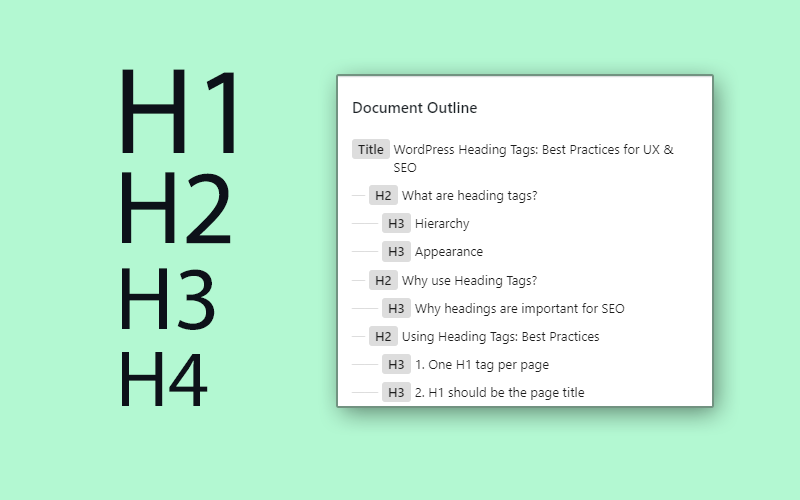

H2s Support H1 While H3s Follow Suit

The relationship between H1, H2, and H3 tags creates a content hierarchy that both users and search engines appreciate. H2 headings should directly support and expand upon the main topic stated in the H1, while H3s should further develop the specific H2 section they fall under.

For SaaS companies creating content about valuation or metrics, this structural relationship might look like:

- H1: SaaS Valuation Multiples in 2025

- H2: Revenue-Based Valuation Methods

- H3: TTM Revenue Multiple Approach

- H3: Forward Revenue Multiple Calculations

- H2: Profitability-Based Valuation Methods

- H3: EBITDA Multiple Considerations

- H3: Cash Flow Multiple Alternatives

This clear structure helps search engines and people see how ideas are linked. This makes it easier to understand content. For SaaS business owners, using this setup for their metrics or industry numbers adds clarity. It also boosts their trustworthiness.

When headings are used correctly, they show expertise on a topic. This can help improve search rankings for SaaS-related terms. It also keeps a professional look that builds trust with clients and investors.

Creating Excellent H1, H2, and H3 SEO Heading Tags

Effective header tags combine SEO best practices with user-centric information architecture. For SaaS companies explaining complex concepts like SaaS multiples or valuation frameworks, headers serve as signposts guiding readers through technical content.

When creating headers for content about SaaS metrics or business models, focus on:

- Keyword integration without sacrificing clarity

- Consistent length (typically under 60 characters)

- Clear hierarchy that reveals content structure at a glance

- Benefit-oriented language that addresses user questions

A good heading structure can help small companies, and partnering with a SaaS SEO Consultant can accelerate these efforts. This is true when they face larger rivals, as it can make their content rank better even if their domain authority is low.

The strategy works for different topics. It helps explain SaaS sales processes, metrics, or ways to value a business. Having the right team with relevant SaaS Skills and perhaps a SaaS Marketing Certification can make all the difference in executing this effectively.

SaaS SEO and Header Tags

The saas industry presents unique SEO challenges due to technical terminology and specialized metrics. Effective header tags help bridge this gap by organizing complex information in accessible ways.

When developing content about saas multiples or valuation metrics, headers should:

- Include industry-specific terminology like ARR or revenue multiples naturally

- Signal expertise through precision rather than generalities

- Build from fundamental concepts to advanced applications

- Address specific pain points of potential acquirers or investors

The link between SaaS SEO and content layout goes beyond just putting in keywords. Headers build connections that help search engines grasp specific SaaS terms and measures. They also show how these relate to larger business ideas.

For SaaS firms explaining how to value their services, a good header layout shows skill and clear thoughts. These are two traits that both search engines and potential clients or investors appreciate.

Descriptive and Keyword-Rich Headings

Effective headers balance SEO requirements with information clarity. For content discussing saas business valuation or revenue multiples, headers should include key terms while maintaining natural language flow.

Examples of effective, keyword-rich headers for SaaS valuation content:

Instead of: “Calculating Values”

Better: “Calculating SaaS Revenue Multiples: Methods and Examples”

Instead of: “Market Factors”

Better: “Market Factors Affecting SaaS Valuation Multiples in Q2 2025”

Instead of: “Growth Considerations”

Better: “How Growth Rate Influences SaaS Company Valuation”

These improved headers include valuable keywords (saas revenue multiples, valuation multiples, growth rate) while providing specific information about the section content.

This method helps search engines find your content. It also lets readers quickly see useful information.

For SaaS business owners, making content about industry benchmarks is key. It shows how well the company is doing. Using clear headers builds trust. It shows you know the industry and its issues well.

H2s and H3s For Scannability

Modern readers typically scan content before committing to full reading.

Effective H2s and H3s facilitate this behavior by providing clear information hierarchy.

For content explaining complex saas metrics or valuation methodologies, consider:

- Keeping headers under 60 characters for easy scanning

- Using parallel structure across similar-level headers

- Front-loading key terms and concepts

- Ensuring each header accurately previews its section content

This method is very helpful for SaaS firms. It explains tough ideas like EBITDA multiples and retention numbers. This commitment to user experience extends beyond content; collaborating with a specialized saas design agency can ensure your entire platform is intuitive.

Similarly, a seamless B2B SaaS Onboarding process is important for retention, a key factor in valuation.

FAQ’s:

How Do I Ensure My SaaS Article Is Structured For Both Readability and SEO?

Use clear H1, H2, and H3 tags to break down topics like saas multiples or valuation metrics.

Include keywords like revenue multiples or saas business model naturally. Short paragraphs and bullet points improve scannability, while header tags help search engines understand your content about saas metrics or competitive edge.

What Are The Most Critical Metrics For Evaluating SaaS Multiples?

Focus on growth rate, annual recurring revenue (ARR), and net revenue retention. Customer acquisition cost (CAC) and customer lifetime value (CLV) ratios matter, along with cash flow and EBITDA margins.

Investors also track the Rule of 40 (growth + profitability) to gauge saas valuation health.

How Can Small To Mid-Sized SaaS Companies Increase Their Valuation Multiples?

Boost retention rates, lower CAC through efficient marketing, and showcase revenue quality.

Improve financial transparency with standardized saas metrics reporting and highlight competitive edge like niche markets or AI integrations. Partnering with advisors like Aventis Advisors can refine your exit strategy.

What External Factors Have The Biggest Impact On SaaS Multiples In The Current Market?

High interest rates and public saas company performance set valuation ceilings.

Trends like artificial intelligence adoption or sector consolidation create premium multiples. Market sentiment shifts quarterly—track reports from firms like FE International for timing exits or fundraising in the current market.

Conclusion

SaaS multiples are key for valuing companies. They help with smart choices and decisions. Many things affect these values.

Factors like growth rate, revenue quality, customer costs, and market trends matter for SaaS worth. Owners of all types of businesses use these metrics. This includes new startups and those looking to go public. These numbers assist with exit plans and raising funds.

The world of valuation is changing fast. Middle multiples shift every few months now.

With high interest rates, firms focus on smart growth. SaaS companies must show they can grow and earn profits.

This will help them get better multiples. The old belief that only revenue growth matters is changing. Now, reviews also look at retention, cash flow, and profit potential. To share these metrics well in investor talks, clear online content is key.

Using H1, H2, and H3 tags helps SaaS firms boost SEO and user experience. This way, their value messages reach the right people effectively. This heading system supports your content for both search engines and users.

At VH-info, we help SaaS firms improve their performance numbers and online strategies, whether it’s by developing a comprehensive saas marketing Playbook or advising on the integration of a SaaS ERP for better operational efficiency.

Our knowledge in SaaS SEO and content layout helps businesses share their worth in a tough market.

As the field changes through 2025, companies that do well in key metrics and online presence will have lasting advantages.

For new entrants, following a comprehensive saas launch checklist is critical. For established players, expanding reach through saas affiliate programs or exploring strategic saas partnership models can be a game-changer.