The number “945” might seem random, but it appears in several important places. It could refer to a specific tax form, a classic car, a piece of computer hardware, or even a telephone area code. Each one has a unique story and purpose.

Just as VH-info helps clarify the complex world of link building, this guide will break down what “945” means in each of these contexts. We’ll give you clear, simple explanations so you know exactly what people are talking about when they mention “945.”

What Is A 945?

The term “945” can mean different things depending on the conversation. It’s not just one thing; it’s a label used in taxes, cars, technology, and even geography. Think of it as a code that changes its meaning based on the subject.

- The 945 in Taxes: IRS Form 945: Most often, “945” refers to IRS Form 945, the Annual Return of Withheld Federal Income Tax. This is a document used to report federal income tax withheld from specific types of payments that aren’t regular wages. We will dive deep into this form, as it is important for many business owners.

- The 945 in Cars: The Volvo 945 Estate: For car lovers, “945” brings to mind the Volvo 945, a well-built station wagon from the 1990s. Known for its safety and boxy design, this car has a loyal following and represents a key part of Volvo’s history.

- The 945 in Technology: Intel’s 945 Chipset: In the tech world, “945” points to the Intel 945 chipset family. These chipsets were like the traffic directors on a computer’s motherboard, managing how different parts communicated with each other during the mid-2000s.

- The 945 in Geography: Area Code 945: If you get a call from area code 945, you’re hearing from the Dallas, Texas area. This area code was added to serve the growing population in and around the city, showing how numbers are used to organize our communication networks.

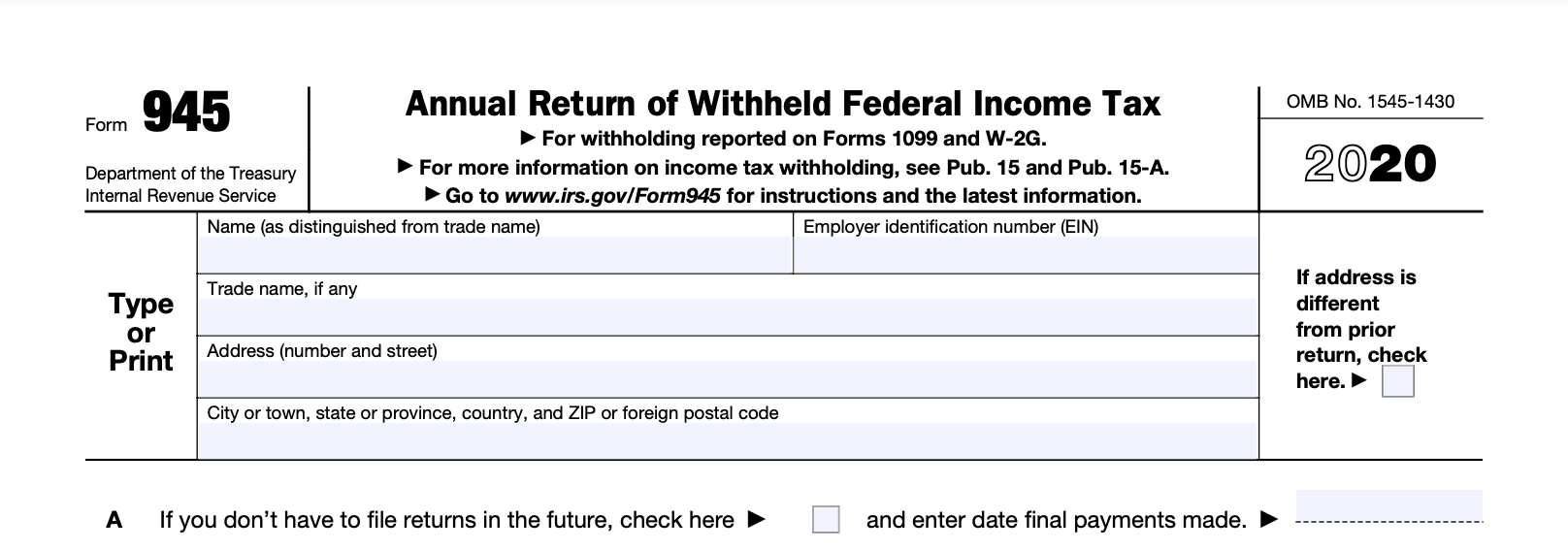

Understanding IRS Form 945

IRS Form 945 is an important tax form for reporting federal income tax withholding on nonpayroll payments.

These are payments made outside of the regular salary you give to employees. You file this form once a year to report the total taxes you withheld for the entire calendar year. It serves as an annual record for the Internal Revenue Service. Getting this right is vital. For businesses focused on growth, handling details like your annual withholding tax return correctly is as important as your marketing strategy.

At VH-info, we believe in clear, effective strategies, whether it’s for link building or understanding your tax obligations.

Who is Required to File Form 945?

You must file Form 945 if you withheld any federal income tax, including backup withholding, from specific types of payments.

These payments include:

- Pensions (including distributions from 401(k)s, IRAs, and other retirement plans)

- Military retirement pay

- Gambling winnings

- Payments to an Alaska Native Corporation

- Certain government payments

- Payments are subject to backup withholding

If you make these kinds of payments, you are responsible for withholding the correct tax and reporting it on this annual return. You’ll need an Employer Identification Number (EIN) to file.

What Payments Are Reported On Form 945?

The primary purpose of filing Form 945 is to report the total amount of federal income tax withheld from nonpayroll payments.

This includes any backup withholding you were required to take out. Backup withholding often applies when a recipient doesn’t provide a correct Taxpayer Identification Number (TIN), which could be a Social Security Number or EIN. The form summarizes your tax liability for the tax year. You must report the total withheld income taxes and the deposits you made throughout the year.

The goal is to ensure that the total amount of backup withholding and other withheld taxes are sent to the government correctly.

Filing Deadlines and Procedures

The main due date for filing Form 945 is January 31st following the end of the tax year. So, for the 2025 tax year, your form is due by January 31, 2026. However, if you have made all your federal tax deposits on time and have a zero balance due, you get an extra 10 days to file.

If the due date falls on a weekend or a legal holiday, you must file by the next business day.

Making sure you meet the deadline is essential to avoid penalties. Think of it like a campaign deadline—missing it can cause problems. A clear schedule, like the one we use at VH-info to deliver high-quality backlinks, ensures everything runs smoothly.

How to File Form 945?

Filing Form 945 requires careful attention to detail to ensure the right amount of tax is reported and paid. You can file either electronically or by mail.

First, you need your Employer Identification Number (EIN). If you don’t have one, you must apply for it. At the top of the form, you will enter your EIN, name, and address.

Next, you will report the total amount of federal income tax you withheld from all nonpayroll payments for the calendar year. You also need to report the total deposits you have made. If your total taxes are more than your deposits, you will have a balance due. If you deposited more than your total tax liability, you have an overpayment.

For your deposits, many businesses are required to use the Electronic Federal Tax Payment System (EFTPS). This is a free service from the U.S. Treasury that allows you to make your tax payment online or by phone.

Some small business filers with a smaller nonpayroll tax liability may be able to pay when they file.

You must complete the Annual Record of Federal Tax Liability (Form 945-A) or the Monthly Summary of Federal Tax Liability section if your federal tax liability is $2,500 or more for the year. This breaks down your liability by deposit period.

If you choose paper filing, the address for where to mail Form 945 depends on your location. You can find the correct address on the IRS website or in the form instructions.

Finally, if you use a paid preparer to complete your tax returns, they must sign the form and enter their Preparer Tax Identification Number (PTIN).

Common Mistakes to Avoid When Filing Form 945

Mistakes on tax forms can lead to notices, penalties, and headaches.

Here are some common errors to watch out for when preparing your annual return of withheld federal income tax:

- Using the Wrong Form: A frequent mistake is confusing Form 945 with Form 941, the Employer’s Annual Federal Tax Return. Remember, Form 941 is for payroll tax (wages paid to employees), while Form 945 is for nonpayroll items like pensions and gambling winnings.

- Incorrectly Calculating Tax Liability: Double-check your math. Ensure the total taxes reported match the sum of your withheld amounts throughout the previous year. A small error can create a mismatch with the deposits you’ve made.

- Missing the EIN: Forgetting to put your Employer Identification Number on the form is a simple but common mistake that can delay processing.

- Failing to Make Timely Deposits: You can’t just wait until January 31st to pay everything. You must deposit the withheld income tax withholding according to your deposit schedule (either monthly or semi-weekly). Failure to make timely deposits can result in penalties, even if you file the form on time.

- Not Filing at All: Some business owners assume that if they didn’t withhold any taxes, they don’t need to file. However, if you are required to file Form 945 but had no tax withholdings, you must still file a return showing zero liability.

Avoiding these mistakes is key. Just as a strong link-building strategy from VH-info requires precision, so does your tax reporting. Getting the details right from the start saves time and money.

A Look At the Volvo 945

Shifting gears from taxes to cars, the “945” also refers to the Volvo 945. This model was a station wagon, or “estate,” that was part of Volvo’s 900 Series. It became famous for its practical design, large cargo space, and reputation for being incredibly safe and durable.

History and Production of the Volvo 945

The Volvo 945 was produced from 1990 to 1998. It was an evolution of the older Volvo 740, sharing a similar body but with updated features and styling. The car was built with quality and longevity in mind, which is why you can still see many of them on the road today.

It was a true workhorse, loved by families and anyone who needed to carry a lot of stuff without sacrificing comfort.

Key Features and Engine Specifications

The Volvo 945 was known for its rear-wheel-drive layout, which was common for larger cars at the time. It came with several engine options, including reliable four-cylinder gasoline engines, some of which were turbocharged for extra power.

Key features included:

- A huge cargo area, especially with the rear seats folded down.

- A tight turning circle, making it surprisingly easy to maneuver for a large car.

- Volvo’s signature safety features, like a strong safety cage, side impact protection, and anti-lock brakes (ABS).

The Legacy of this Classic Station Wagon

The Volvo 945 left a lasting legacy as one of the most iconic station wagons ever made. Its boxy but functional design became a symbol of practicality and safety. It solidified Volvo’s reputation as a brand that built cars to last.

For many, the 945 represents an era of simple, dependable engineering before cars became filled with complex electronics.

Exploring the Intel 945 Chipset

In the world of computers, “945” brings us to the Intel 945 chipset family.

Released around 2005, this chipset was a critical component on motherboards designed for Intel processors. Think of the chipset as the motherboard’s nervous system—it controls the flow of data between the processor, memory, and other devices.

Overview of the 945 Chipset Family (945P, 945G, 945GC)

The Intel 945 family came in several versions:

- 945P: A mainstream performance chipset that required a separate graphics card.

- 945G: This version included integrated graphics, meaning you didn’t need to buy a separate video card. It was a popular choice for budget-friendly and business computers.

- 945GC: A lower-cost version of the 945G, often used in entry-level desktop computers. It had slightly reduced capabilities but offered great value.

Supported Processors and Memory

The 945 chipset was made to work with well-known Intel chips from its time. These chips were the Pentium 4, Pentium D, and Celeron D. The Pentium D had two cores, which helped it do more tasks at once.

The 945 chipset was also one of the first main chipsets to use DDR2 memory. DDR2 memory was much faster than the old DDR memory. It gave computers better speed and stronger performance. This made the 945 chipset a good choice for many users back then.

Impact on Personal Computing in its Era

The Intel 945 chipset helped make computers better. It brought dual-core processors to many people. It also made memory faster, which was needed for the new Windows Vista and harder programs.

The 945G and 945GC types came with built-in graphics. This meant that people could save money because they did not have to buy a separate graphics card for simple computer jobs. The chipset made stronger computers more affordable for everyone.

FAQ’s:

What is the Most Common Meaning of “945”?

The most common meaning is IRS Form 945, the Annual Return of Withheld Federal Income Tax. While it also refers to a car and a chipset, its use in the tax world is the most widespread and officially documented.

How is IRS Form 945 Different From Form 941?

Form 945 is for reporting income tax withholding on nonpayroll payments, such as pensions, gambling winnings, and payments subject to backup withholding. Form 941 is the employer’s quarterly federal tax return, used to report wages paid to employees and their payroll tax withholdings, like social security and Medicare taxes.

What is the Deadline For Filing Form 945?

The deadline is January 31st of the year after the tax year ends. If you made all your tax deposits on time, the deadline is extended to February 10th. If the date is on a weekend or holiday, you file on the next business day.

Can Form 945 Be Filed Electronically?

Yes, electronic filing of Form 945 is not only possible but encouraged by the IRS.

You can use approved IRS e-file software or have a tax professional file it for you. Payments can be made via the Electronic Federal Tax Payment System (EFTPS) using a debit card or a transfer from a financial institution.

What Happens If I File Form 945 Late?

Late filing of Form 945 can result in penalties and interest charges. The penalty is typically a percentage of the unpaid tax, calculated based on how late the filing is. There are also penalties for failing to make the required federal tax deposits on time throughout the year.

Is There A Way to Request an Extension For Filing Form 945?

No, there is no extension of time to file Form 945. However, if you need more time to pay your federal tax liability, you may be able to request a payment plan, but this will not stop penalties and interest from accruing on the late payment.

Do I Need to File Form 945 If No Taxes Were Withheld?

If you are required to file Form 945 (for example, because you filed one in the prior year and haven’t closed your account), you must file it even if you had no tax withholdings and no tax liability. In this case, you would file a “zero return.”

How Do I Correct A Mistake On A Previously Filed Form 945?

To correct a mistake on a previously filed form, you use Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund. This form allows you to correct errors related to underreported or overreported taxes from a previous year.

Are Volvo 945 Cars Still Available Today?

Yes, you can still find Volvo 945 cars on the used car market. They are popular among enthusiasts who appreciate their simple mechanics, durability, and large cargo capacity. Finding one in good condition can be a rewarding experience.

Conclusion

The number “945” has a surprisingly rich set of meanings. It represents the important annual withholding tax return that many businesses must file, a beloved classic car known for its reliability, a foundational piece of computer technology, and a regional identifier for Dallas.

The most complex of these is undoubtedly IRS Form 945, where getting the details right is essential for staying compliant.

From understanding your nonpayroll tax liability and making timely deposits to ensuring your annual record of federal tax liability is accurate, managing your tax obligations is a critical business function.

It requires the same level of expertise and attention to detail that we at VH-info apply to building powerful link-building strategies for our clients. By handling these duties correctly, you ensure your business operates smoothly, freeing you up to focus on growth.